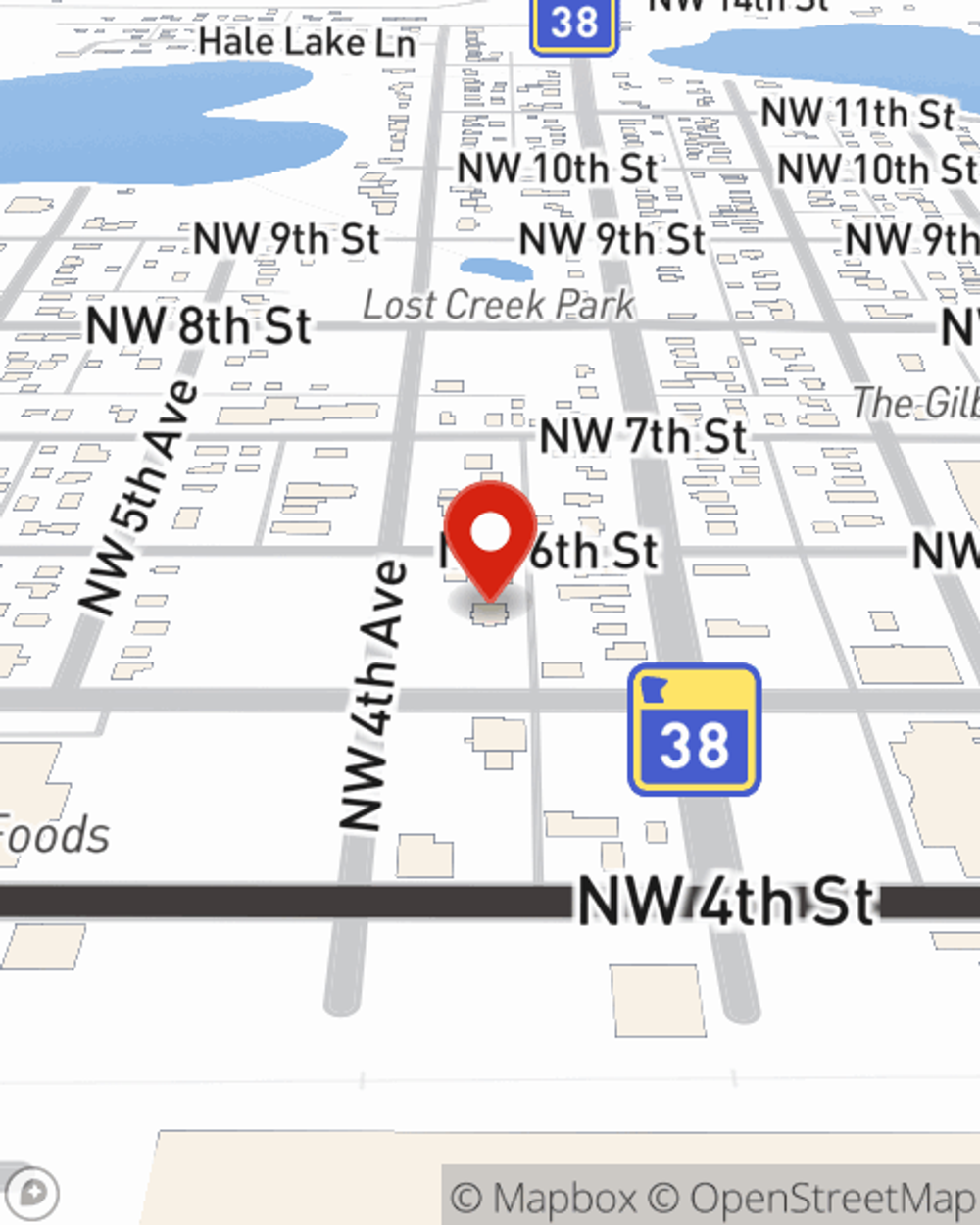

Business Insurance in and around Grand Rapids

Get your Grand Rapids business covered, right here!

Helping insure small businesses since 1935

- Grand Rapids

- Cohasset

- Itasca County

- Hill City

- Deer River

- Coleraine

- Remer

- Longville

- Crosby

- The Iron Range

- 1,000 Lakes

- Northome

- Duluth

- Aitkin

- Saint Louis County

- Bovey

- Twin Cities

- Cass County

- North Dakota

- South Dakota

- Iowa

- St Paul

- Minneapolis

- Hennepin County

This Coverage Is Worth It.

Running a small business is no joke. Insuring your venture should be the least of your worries. State Farm insures small businesses that fall under the umbrella of retailers, specialized professions, contractors and more!

Get your Grand Rapids business covered, right here!

Helping insure small businesses since 1935

Cover Your Business Assets

Your business is unique and faces a wide array of challenges. Whether you are growing a fabric store or a book store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Terry LaValle can help with business continuity plans as well as life insurance for a group if there are 5 or more employees.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Terry LaValle is here to help you explore your options. Call or email today!

Simple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Terry LaValle

State Farm® Insurance AgentSimple Insights®

Understanding the insurance premium audit process

Understanding the insurance premium audit process

As a business owner, you may be contacted to complete an insurance premium audit. Learn what the insurance audit process entails and how to prepare.

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.